Like a recurring bad dream, it’s health insurance open enrollment again. Whether you have your health insurance through your employer, from healthcare.gov, or Medicare, no doubt your mailbox has been full of notifications with changes to your plan, or solicitations to new options. When I ask people about this, most say they file them in the circular file cabinet (or the recycling bin) and go on about their lives. But maybe, what you’re throwing away is an occasional pumpkin latte, a subscription to that streaming service you didn’t think you could afford, or even some extra $$ in your checking account every month.

Like a recurring bad dream, it’s health insurance open enrollment again. Whether you have your health insurance through your employer, from healthcare.gov, or Medicare, no doubt your mailbox has been full of notifications with changes to your plan, or solicitations to new options. When I ask people about this, most say they file them in the circular file cabinet (or the recycling bin) and go on about their lives. But maybe, what you’re throwing away is an occasional pumpkin latte, a subscription to that streaming service you didn’t think you could afford, or even some extra $$ in your checking account every month.

I know most of us would rather endure a good poke in the eye than to scrutinize our health insurance options. So are there specific circumstances that prompt you to endure the torture, take the time to review your health benefits options and consider changes?

The good news first. You may not need to. If there have been no changes in your health or your prescription medications, your doctors and preferred hospitals still participate with the plan you have, and there haven’t been any substantive changes in the cost of your plan, you’re probably OK to re-up and keep on keepin’ on.

When should I take a closer look?

However if any of these things have happened in the last year, or will happen in the coming year, it might be worth a closer look.

- My prescription medications that I take routinely have changed or gotten more expensive.

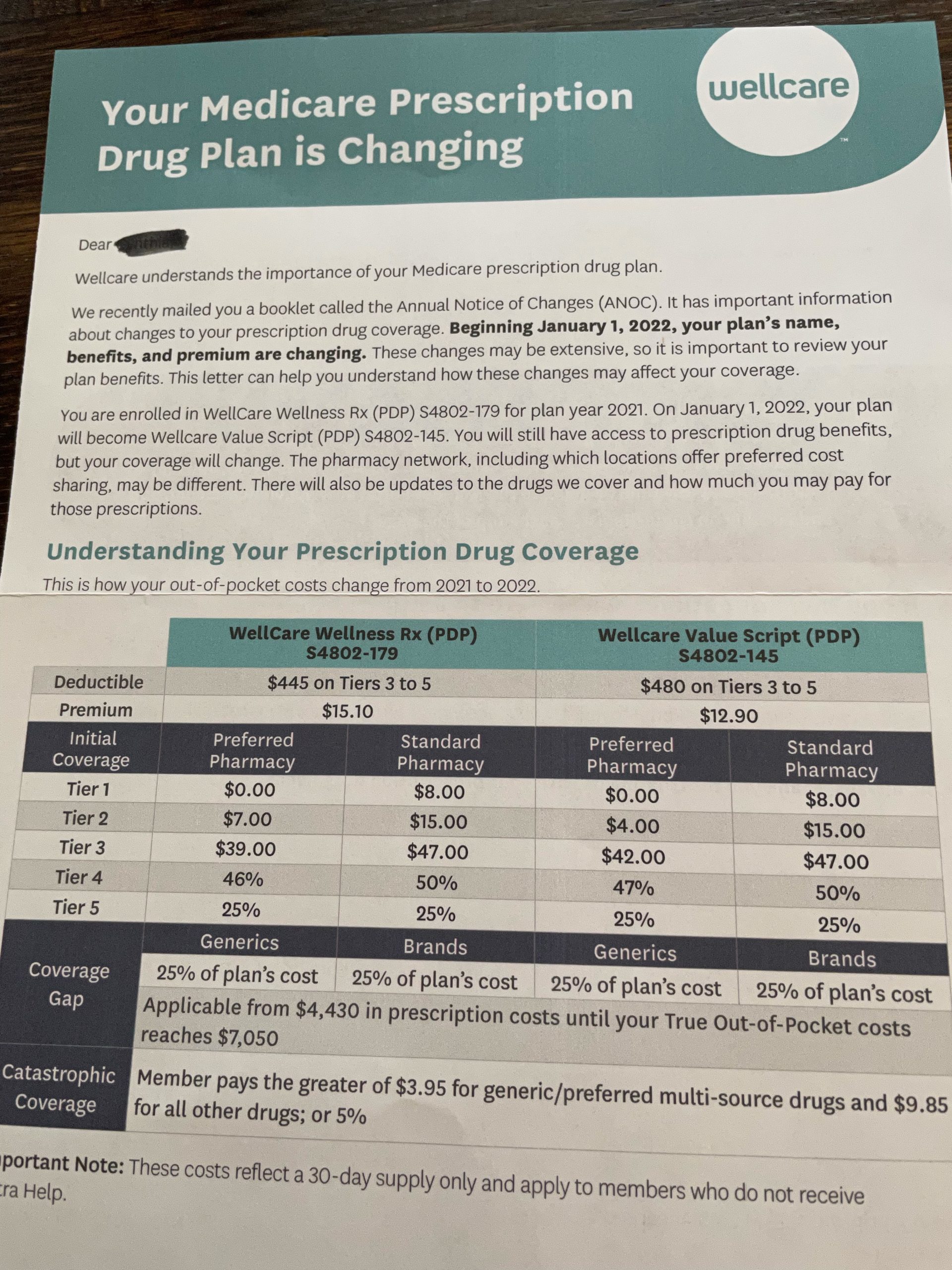

Drug costs are extremely variable year to year. Drug formularies often change year to year. Knowing how your new medications are covered and aligning your coverage accordingly can result in big savings. If you’re on Medicare, the average beneficiary has 33 drug plans to choose from.

- I will need surgery or specialized treatment in the coming year.

Making sure that the specialists you want are covered under your plan can be the difference between treatment with the doctor you want, and having to re-vamp your treatment plan.

- You have COBRA or retiree benefits.

These kinds of benefits can be changed annually and open enrollment is usually when the changes are communicated. These changes can impact your costs and coverage and carefully reviewing the options will avoid financial surprises.

- You think you might move or spend time in another state.

Knowing how your plan covers care if you’re away from your residence is perhaps the most important tool you have to avoiding expensive health care. For hwalthcare.gov and Medicare beneficiaries moving will trigger the need to enroll in new coverage.

- Your income has changed, increased or decreased.

If you have your health benefits through your employer and you’ve had a change in income, evaluating all the options you have may help manage costs, either by selecting a different plan or even looking at options for using a Health Savings Account. If you have your benefits through healthcare.gov or Medicare, changes in income can impact what you pay each month, perhaps making insurance more affordable, or incorporating increased premium costs into your financial planning.

- Your doctor has left the practice, retired or gone concierge.

If you find you are having to rebuild your medical team, it can be a good time to re-look at your health insurance coverage. It may refine where to start looking, or to drive a different look at your coverage altogether.

Don’t leave $$ on the table!

Examining your options for open enrollment may not be high on your to-do list. But before you throw all those notifications away, consider a closer look. Don’t leave money on the table! An annual health insurance review can be worth the investment. We can help. Call for a brief, no-cost consultation.